Trusted By 500+

Businesses Nationwide

Effortless GST Filing Stay Compliant, Maximize Savings

Navigating Goods and Services Tax can be complex. Easeupnow makes GST compliance simple, accurate, and stress-free for your business.

Mergers and Acquisitions are Complex and Time Consuming

Navigating mergers and acquisitions brings risks like overpaying, hidden liabilities, and complex negotiations. Without expert help, deals can fail, draining time and resources from your core operations..

Our dedicated M&A team partners with you from initial strategy to final integration, ensuring a smooth process that achieves your financial and strategic objectives.

200+

10+

5+

Our Mergers and Acquisition Services

Get accurate business valuations to ensure fair deals. We analyze your assets and market trends so you make informed decisions.

How EaseUp Makes Merger & Acquisition Simple & Smart

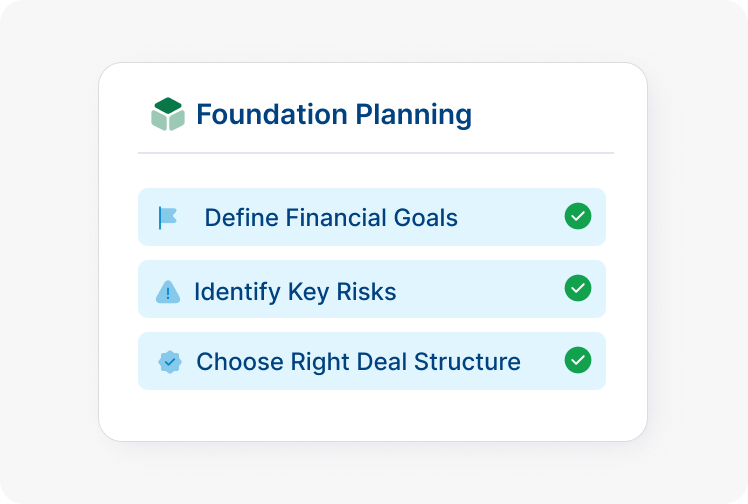

1. Strategic Assessment

We define your financial goals, identify risks and help determine the optimal deal structure for you.

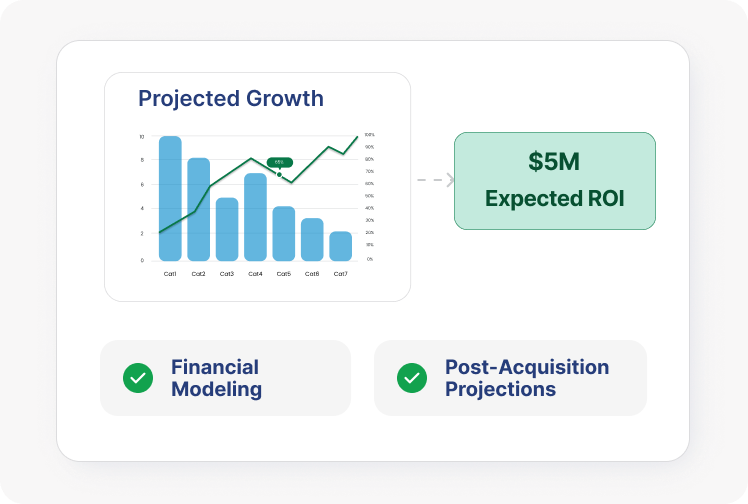

2. Valuation and Preparation

We build custom financial models to project post-acquisition performance, benefits, and precise ROI to negotiate confidently and secure the deal.

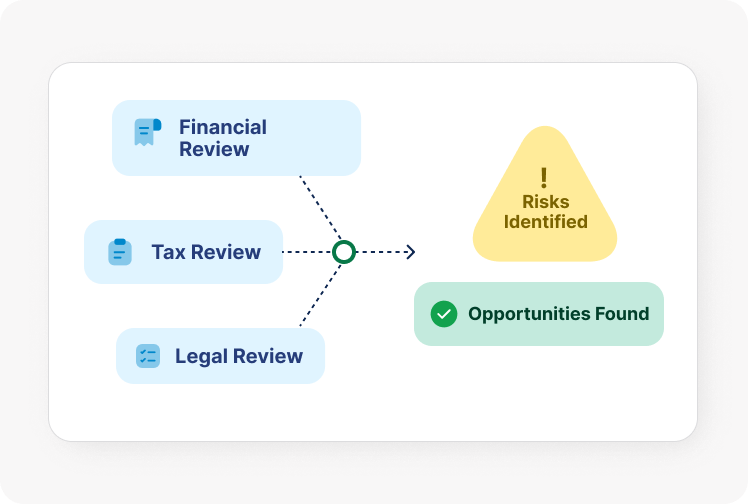

3. Due Diligence & Review

We conduct a thorough financial, Tax & Legal Due Diligence of the target company or prepare your records for review to identify hidden liabilities and critical opportunities.

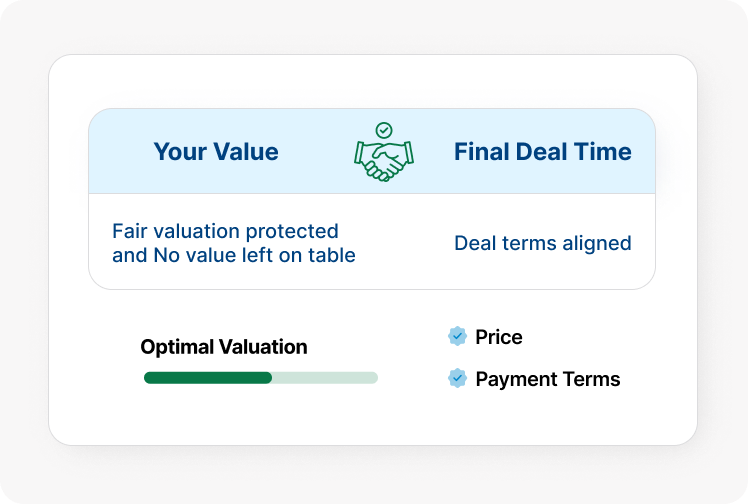

4. Negotiation & Structuring

We provide expert financial advisory during negotiations and ensure the final deal terms reflect the true value of your business or acquisition target.

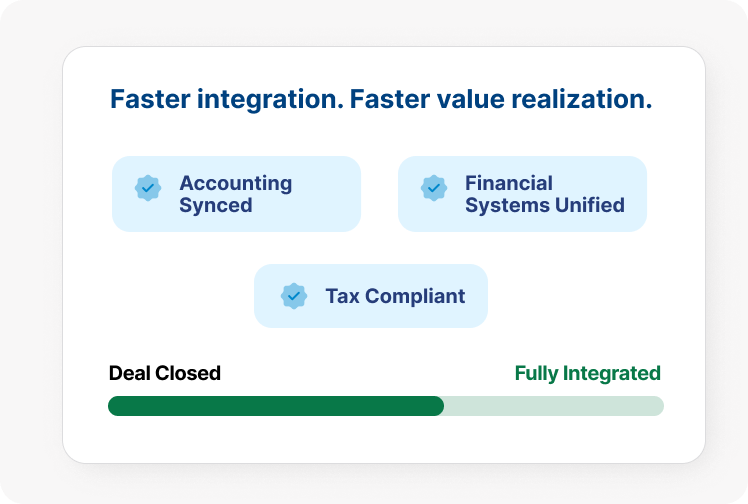

5. Closing & Integration

We help integrate accounting, tax and financial systems quickly and compliantly, so you capture the deal's value faster.

This is the first tool developed

FOR and WITH the help of real Project masters..

SAP S/4HANA

We recognize that managing complex workflow can be overwhelming.

SAP Concur

We recognize that managing complex workflow can be overwhelming.

Cross-Application

We recognize that managing complex workflow can be overwhelming.

Salesforce

We recognize that managing complex workflow can be overwhelming.

Workplay

We recognize that managing complex workflow can be overwhelming.

SAP SuccessFactor

We recognize that managing complex workflow can be overwhelming.

Why Choose EaseUp for Mergers and Acquisition?

Specialized Accounting Built for Your Business

Our Pricing Plans

Startup

What you will get

Handling all incorporation and EIN setup.

Support for tracking stock, options, and early equity.

Monthly reporting optimized for funding rounds and due diligence.

S-Corp election planning and guidance on tax incentives.

E-commerce / D2C

Mastering multi-platform sales, inventory valuation, and complex sales tax compliance.

₹7,999

What you will get

Seamless sync and reconciliation for Shopify, Amazon, etc.

FIFO/LIFO valuation and accurate Cost of Goods Sold tracking.

Monitoring sales tax nexus and compliance across state lines.

Linking ad platform expenses to specific revenue streams for true profitability insights.

Manufacturing

Tracking production costs, inventory levels, and optimizing profitability per unit.

₹12,999

What you will get

Detailed tracking of Direct Materials, Direct Labor, and Manufacturing Overhead.

Accurate accounting for goods still in the production pipeline.

Tracking Raw Materials and Finished Goods to prevent stockouts/waste.

Proper depreciation scheduling for heavy machinery and equipment.

What Our Clients Say

Before Autonest, our operations were scattered across multiple tools — tracking vehicle data, managing schedules, and monitoring performance all felt like a juggling act. As a fleet management company, every minute and every decision matters. We needed a smarter, more centralized system that could grow with us. Autonest exceeded our expectations.

From the onboarding process to daily use, the platform has been intuitive and seamless. Within the first month, we noticed a drastic reduction in administrative overhead. What used to take hours of manual tracking is now automated — reports, alerts, and analytics are all at our fingertips.

We’ve evaluated dozens of SaaS platforms in the past five years, and very few have made the impact that Autonest has. Our team needed a reliable, scalable, and smart solution to manage our operational workflows. Autonest delivered — and then some.

Implementation was a breeze. The integrations with our existing tools (Slack, Zapier, and Google Workspace, to name a few) worked out of the box. Within days, we had streamlined several repetitive processes, freeing up our engineers and operations managers to focus on higher-value tasks.

Managing logistics operations at scale is chaotic by nature — shifting deadlines, unexpected delays, and constant coordination. We were desperate for a tool that didn’t just digitize our processes but actually organized them. That’s when we discovered Autonest.

Right from the demo, we were impressed by how thoughtful and feature-rich the platform was. The customization options allowed us to tailor workflows to our specific needs without writing a single line of code. The real-time notifications, centralized dashboard, and role-based access transformed how our teams communicated and collaborated.

Ready to advance the success of your next M&A move?

Get a precise, expert valuation and strategic plan. Request your free, confidential consultation to ensure maximum returns.

Get Started with a Smooth M&A Journey

Define Transaction Strategy

We understand your objectives buy-side, sell-side or restructuring and outline the optimal deal structure, scope and timelines.

Prepare & Review Transaction Data

We assist with financial readiness, data room setup, due diligence coordination and issue identification to avoid delays and surprises.

Execute with Clarity & Confidence

We support valuation alignment, negotiation and closure with clear financial insights and transaction-focused advisory.

FAQ's

Top Merger and Acquisition Queries

The timeline varies significantly based on complexity, size, and due diligence requirements, but a standard transaction can take anywhere from 6 to 12 months from initial strategy to closing.